Bid-Ask Price Calculator

Bid Price

Ask Price

Answer

What is the Bid-Ask Price calculator?

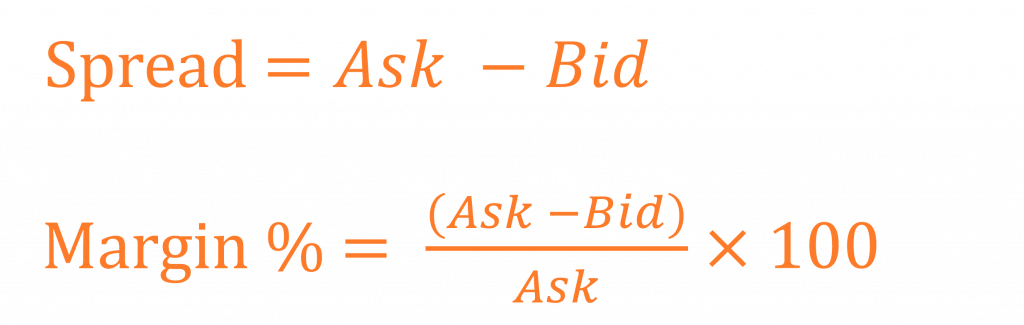

Meet our bid-ask price calculator, also known as the bid/ask calculator. This handy tool helps you determine both the spread amount and margin percentage between two given prices.

The spread represents the variance between the quoted “selling” price (ask) and the quoted “buying” price (bid) for a security, stock, or currency.

The bid-ask margin is also known as the “spread percentage” and represents the difference between the bid and ask prices expressed in percentage form. If the spread/margin is 0, the asset is known as “frictionless”.

Why is the Bid-Ask Price calculator useful?

This calculator is great for gauging market dynamics by instantly computing the difference between the bid (buy) and ask (sell) prices. Understanding this spread is essential for making informed decisions in financial markets.

Traders can utilize it to assess market liquidity and potential profitability, while investors can evaluate the cost of entering or exiting positions. For example, in the fast-paced world of currency trading, the bid/ask price calculator aids in comprehending the transaction costs associated with buying or selling foreign exchange. Whether you’re navigating stocks, commodities, or cryptocurrencies, this calculator empowers users to optimize their trading strategies by providing insights into market conditions and ensuring more informed decision-making.

Where can I find out more about about bid, ask prices and spreads?

For additional information and an in-depth explanation on bid prices, please refer to the following Wikipedia reference.

For additional information and an in-depth explanation on ask prices, please refer to the following Wikipedia reference.

For additional information and an in-depth explanation on bid-ask spreads, please refer to the following Wikipedia reference.